Business Credit Machine

We offer the premier business credit builder software on the market, delivering exceptional efficiency in all our services

About Us

Business Credit Builders and Funder

Welcome to Credit Healing, your premier partner in business credit building and funding solutions for both personal and business finance. Our mission is to empower entrepreneurs and business owners to establish and grow their credit profiles, secure funding, and achieve their financial objectives.

With years of industry experience, our dedicated team is committed to providing personalized and effective services tailored to the unique needs of our clients. We understand that building credit and obtaining funding can be challenging, which is why we strive to simplify the process and guide you every step of the way.

Whether you are just starting out or looking to expand your business, Credit Healing has the expertise and resources to support your success.

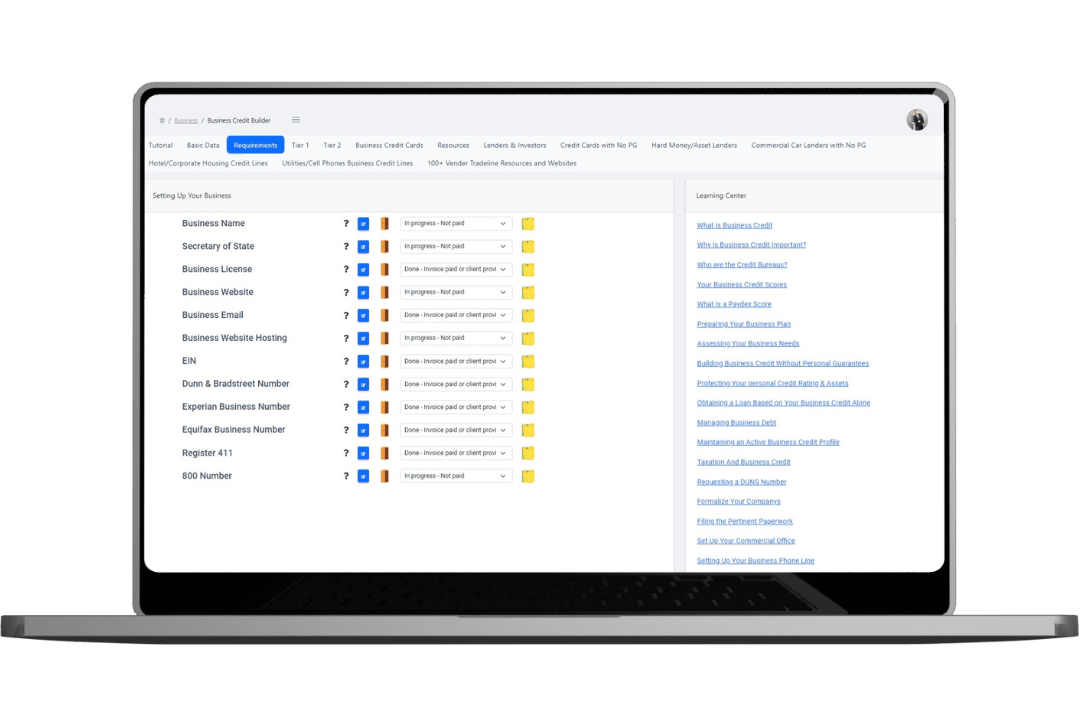

- AI Powered DIY Business Credit Machine

- Intuitive User-Interface

- Simple Step-by-Step Educational Videos

- Assist Attaining Business Bank Loans

- Join Our Business Credit Community

- 100% Approval Guarantee!

Our Services

What We Offer

Business Credit Machine

Simplify building your business credit from start to finish with our powerful

state-of-the-art Business Credit Builder software.

Incorporate Your Business

Are you too busy to incorporate and license your business? Give us a call at 225-733-6429

and we will handle everything for you.

Funding Opportunities

Whether you need personal funding, business funding or hard-money lending, we can help you get approved in as early as 48 hours!

We provide a perfect way to build your business credit Request your Quote

Testimonials

What Clients Say About Us