Authorized User Tradelines

Quickly Improve Your Credit Scores

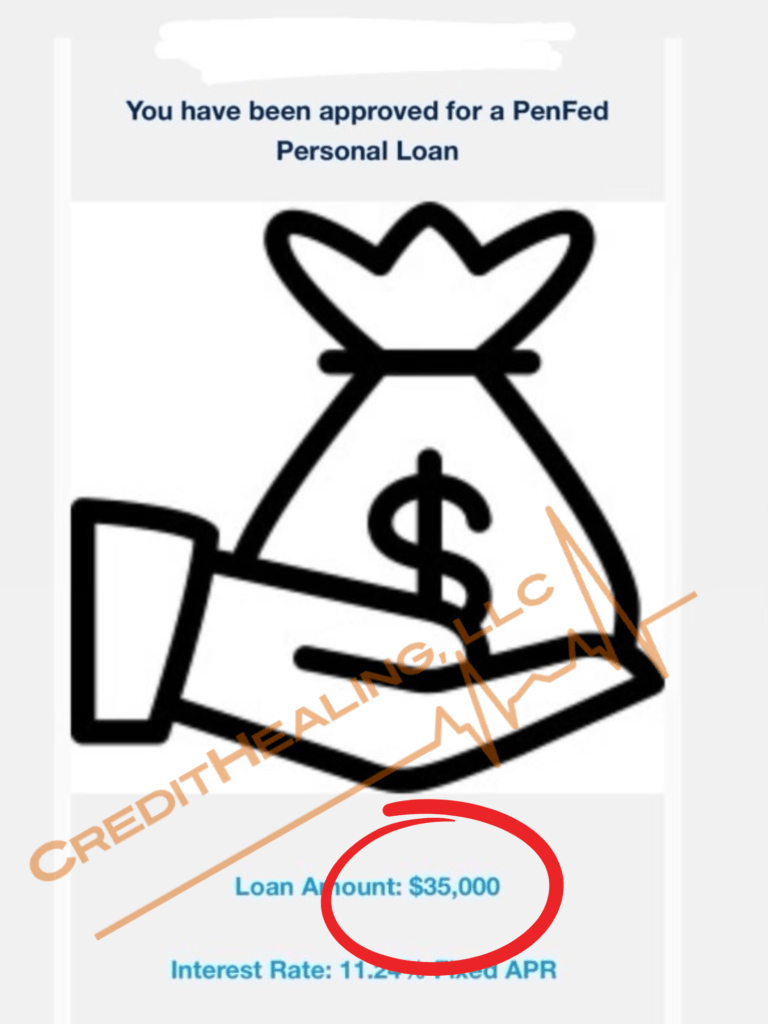

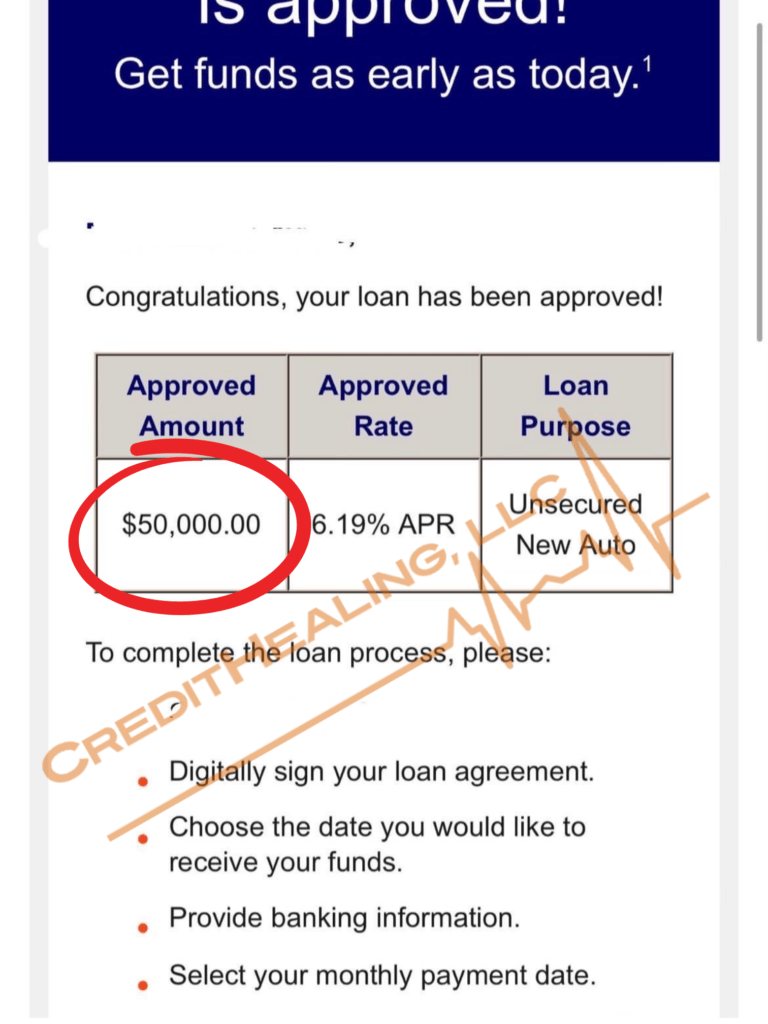

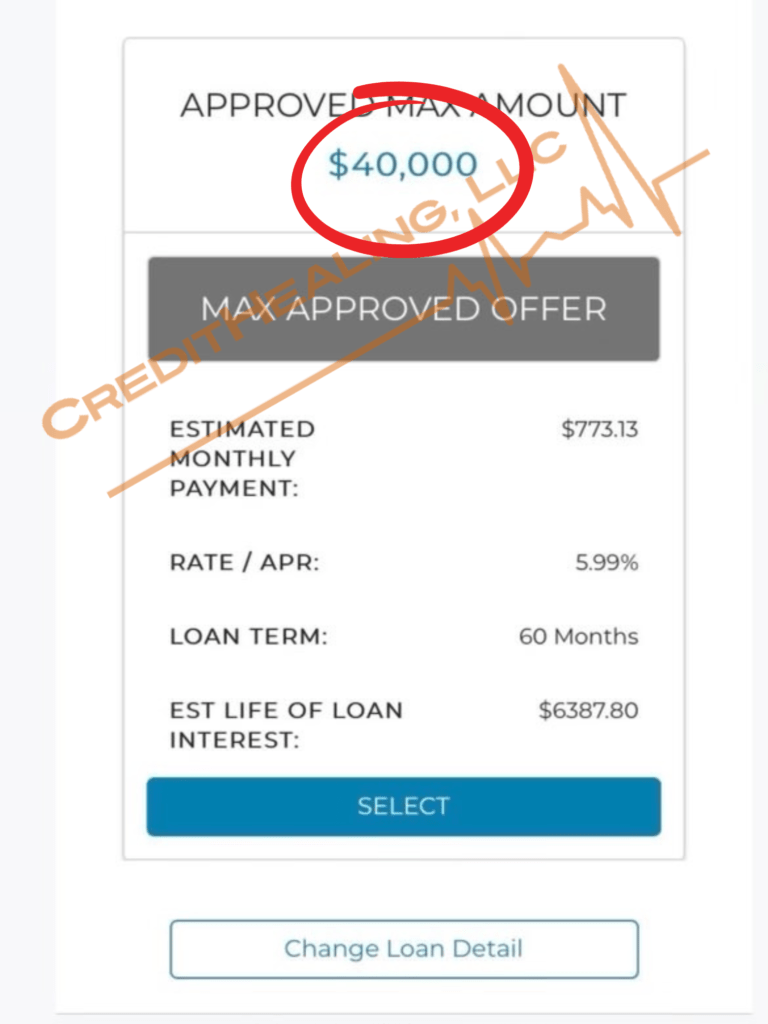

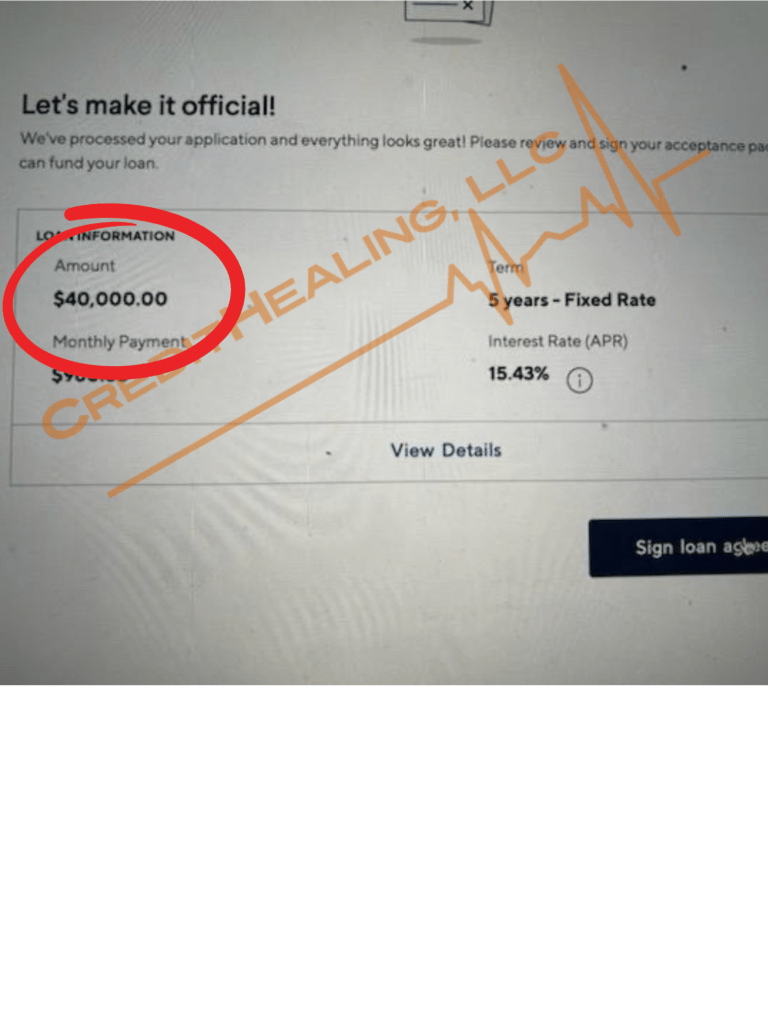

Authorized User Tradelines are great for establishing new credit, building business credit, purchasing a home, renting an apartment, leasing a car and more. We guarantee that our tradelines have low utilization and excellent credit histories. This grants you the greatest possible FICO® score boost in 30 days or less!

About Our Authorized User Tradelines

1. AUs are not entitled to use the account or make changes.

2. AUs do not access the physical card or associated credit line.

3. AUs are not responsible for repaying any balances that might be owed.

4.AUs work most effectively when a credit report is free from derogatory information

5. WE DO NOT PROVIDE TRADELINES TO CPNS OR SCNS.

In short, you’ll receive all the goods without the financial risk. Take advantage of this credit-restoring method today!

How do you buy tradelines with Credit Healing ?

Your credit is about to get a boost, and it couldn’t be easier.

Tell Us What You're Looking For

Review the inventory of available lines and submit your application. We highly recommend you possess little to no derogatory items before applying for our tradelines.

We'll Place the Tradeline on Your Credit File

You’ll be added to the credit line and your credit report will be updated. Buy as many lines as you want.

Boost Your Credit

Strengthen your credit report using your rented credit history. Capitalize on your enhanced credit for 30, 60 or 90 days.

| Inventory ID | Bank/Lender | Credit Limit (total credit limit) | Account History (month and year account was opened) | # of Cycles (number of months account shows on your credit report) | Statement Date (post 5-7 days after) | Cost | Inventory Remaining |

|---|---|---|---|---|---|---|---|

| XH002 | Chase | $5,000 | Jan-15 | 3 | 12/8/2023 | $875 | 1 |

| CH001 | Capital One | $7,000 | Mar-04 | 3 | 12/8/2023 | $1,325 | 1 |

| LP007 | Barclay | $10,000 | Jul-18 | 3 | 12/8/2023 | $850 | 2 |

| OW002 | Chase | $8,400 | Apr-16 | 3 | 12/8/2023 | $925 | 1 |

| KMA002 | Chase | $18,400 | Sep-21 | 3 | 12/8/2023 | $785 | 1 |

| DX002 | Chase | $23,500 | Mar-22 | 3 | 12/9/2023 | $760 | 2 |

| LD004 | Capital One | $5,000 | Nov-10 | 3 | 12/9/2023 | $1,075 | 1 |

| DZ002 | Capital One | $5,700 | Jun-08 | 3 | 12/10/2023 | $1,225 | 1 |

| JC001 | Pen fed | $25,000 | Dec-19 | 3 | 12/10/2023 | $925 | 1 |

| SK005 | Capital One | $5,000 | Mar-19 | 3 | 12/10/2023 | $770 | 2 |

| RH006 | Pen Fed | $39,500 | Nov-16 | 3 | 12/10/2023 | $1,200 | 2 |

| EG002 | Discover | $11,800 | Mar-96 | 3 | 12/11/2023 | $1,600 | 1 |

| CJA003 | Discover | $4,500 | Jan-15 | 3 | 12/11/2023 | $875 | 1 |

| JC017 | Capital One | $4,500 | Aug-15 | 3 | 12/11/2023 | $875 | 1 |

| JX001 | Chase | $19,200 | Jun-04 | 3 | 12/11/2023 | $1,425 | 1 |

| BVK004 | Discover | $13,000 | Jan-06 | 3 | 12/11/2023 | $1,325 | 1 |

| GG001 | Chase | $21,600 | Oct-21 | 3 | 12/11/2023 | $785 | 1 |

| TN009 | Capital One | $23,500 | Apr-18 | 3 | 12/12/2023 | $950 | 1 |

| KT005 | Capital One | $10,000 | Jul-22 | 3 | 12/12/2023 | $730 | 1 |

| JC016 | Capital One | $20,000 | Jul-07 | 3 | 12/12/2023 | $1,350 | 1 |

| AG001 | Chase | $7,800 | Feb-18 | 3 | 12/12/2023 | $850 | 1 |

| SK003 | Capital One | $4,250 | Jan-12 | 3 | 12/12/2023 | $1,025 | 1 |

| BMC007 | Chase | $5,000 | Nov-20 | 3 | 12/12/2023 | $750 | 1 |

| LP005 | Capital One | $6,690 | Jan-07 | 3 | 12/12/2023 | $1,250 | 1 |

| SA002 | Chase | $19,000 | Feb-19 | 3 | 12/12/2023 | $875 | 2 |

| LE005 | Pen Fed | $10,000 | May-22 | 3 | 12/12/2023 | $730 | 2 |

| OM005 | Discover | $6,500 | Jun-22 | 3 | 12/12/2023 | $730 | 1 |

| KC001 | Discover | $16,900 | Jul-91 | 3 | 12/13/2023 | $1,750 | 1 |

| KT009 | Bank of America | $6,700 | Jun-21 | 3 | 12/13/2023 | $750 | 1 |

| BW002 | Chase | $15,000 | Mar-17 | 3 | 12/13/2023 | $940 | 1 |

| JC014 | Discover | $12,500 | Dec-06 | 3 | 12/13/2023 | $1,325 | 1 |

| DC007 | Bank of America | $17,000 | Dec-21 | 3 | 12/13/2023 | $785 | 1 |

| OM001 | Capital One | $10,000 | Mar-18 | 3 | 12/13/2023 | $850 | 1 |

| LP006 | Capital One | $10,000 | Oct-14 | 3 | 12/13/2023 | $1,000 | 1 |

| JS004 | Chase | $12,500 | Apr-14 | 3 | 12/13/2023 | $1,000 | 1 |

| DJ001 | Bank of America | $7,000 | Jan-21 | 3 | 12/13/2023 | $750 | 1 |

| BW004 | Chase | $7,500 | Jun-17 | 3 | 12/14/2023 | $875 | 1 |

| MRO001 | Capital One | $8,000 | Jul-21 | 3 | 12/14/2023 | $765 | 2 |

| RR002 | Chase | $20,500 | Apr-09 | 3 | 12/14/2023 | $1,250 | 1 |

| JA005 | Capital One | $5,400 | Jul-11 | 3 | 12/14/2023 | $1,050 | 2 |

| LE001 | Capital One | $12,000 | Sep-17 | 3 | 12/15/2023 | $925 | 1 |

| EC007 | Capital One | $2,500 | Nov-13 | 3 | 12/15/2023 | $900 | 1 |

| KR004 | Capital One | $20,000 | May-22 | 3 | 12/15/2023 | $750 | 1 |

| MM006 | Chase | $11,800 | May-20 | 3 | 12/15/2023 | $775 | 1 |

| DEG011 | Pen Fed | $12,000 | May-20 | 3 | 12/15/2023 | $775 | 2 |

| RH004 | Discover | $9,200 | Nov-16 | 3 | 12/16/2023 | $925 | 1 |

| KM005 | Pen Fed | $15,000 | Jul-21 | 3 | 12/16/2023 | $785 | 2 |

| DC001 | Chase | $12,800 | Mar-18 | 3 | 12/16/2023 | $850 | 1 |

| DE006 | Pen Fed | $10,000 | Oct-21 | 3 | 12/16/2023 | $750 | 2 |

| BMC008 | Chase | $5,000 | Apr-18 | 3 | 12/16/2023 | $810 | 1 |

| LD001 | Capital One | $11,500 | Jul-02 | 3 | 12/16/2023 | $1,425 | 1 |

| SC002 | Navy Federal | $5,000 | Jul-18 | 3 | 12/16/2023 | $810 | 2 |

| CJA002 | Bank of America | $26,000 | Aug-19 | 3 | 12/17/2023 | $925 | 1 |

| AJ001 | Navy Federal | $18,500 | Oct-16 | 3 | 12/17/2023 | $975 | 1 |

| MDE002 | Chase | $15,200 | Aug-18 | 3 | 12/17/2023 | $900 | 2 |

| KMA003 | Navy Fed | $25,000 | Sep-21 | 3 | 12/17/2023 | $800 | 2 |

| MM003 | Chase | $13,200 | Feb-21 | 3 | 12/18/2023 | $765 | 1 |

| AG002 | Bank of America | $7,000 | Oct-17 | 3 | 12/18/2023 | $875 | 1 |

| JX009 | Pen Fed | $24,000 | May-19 | 3 | 12/18/2023 | $925 | 2 |

| NR004 | Discover | $5,500 | May-21 | 3 | 12/18/2023 | $750 | 1 |

| BR004 | Discover | $17,000 | Jun-05 | 3 | 12/18/2023 | $1,400 | 1 |

| JA006 | Capital One | $5,450 | Nov-10 | 3 | 12/18/2023 | $1,075 | 2 |

| TJ001 | Chase | $11,500 | Feb-18 | 3 | 12/18/2023 | $850 | 1 |

| JC009 | Barclay | $10,000 | Jul-20 | 3 | 12/19/2023 | $775 | 1 |

| DR005 | Discover | $7,500 | Jun-07 | 3 | 12/19/2023 | $1,250 | 1 |

| DZ001 | Chase | $14,800 | May-16 | 3 | 12/19/2023 | $950 | 1 |

| RT001 | Discover | $15,000 | Apr-88 | 3 | 12/19/2023 | $1,850 | 1 |

| DEG009 | Capital One | $3,300 | Nov-06 | 3 | 12/19/2023 | $1,175 | 1 |

| BVK003 | Capital One | $20,000 | Apr-22 | 3 | 12/19/2023 | $750 | 1 |

| KT010 | Chase | $19,600 | Jul-22 | 3 | 12/19/2023 | $750 | 1 |

| CL003 | Chase | $15,000 | Jun-16 | 3 | 12/20/2023 | $950 | 1 |

| DEG002 | Chase | $14,700 | Jul-17 | 3 | 12/20/2023 | $925 | 1 |

| MS001 | Chase | $3,100 | Nov-19 | 3 | 12/21/2023 | $750 | 1 |

| SK009 | Chase | $6,000 | May-13 | 3 | 12/21/2023 | $1,000 | 1 |

| DV002 | Barclay | $10,500 | Jun-13 | 3 | 12/21/2023 | $1,000 | 2 |

| DEG005 | Discover | $14,000 | May-17 | 3 | 12/21/2023 | $925 | 1 |

| MM001 | Pen Fed | $10,000 | Jul-16 | 3 | 12/21/2023 | $925 | 1 |

| PH002 | Barclay | $17,500 | Apr-20 | 3 | 12/21/2023 | $825 | 1 |

| LD003 | Chase | $20,800 | Nov-21 | 3 | 12/21/2023 | $785 | 1 |

Frequently Asked Questions

What does Credit Healing do?

We connect people like you who are looking to increase their credit score by purchasing authorized user tradelines with people who want to sell their unused credit card spots.

How Much Will My Credit Score Increase?

We cannot predict how much your score can increase as many factors contribute to your credit score. However, one of the important factors is good credit history. The age of the line, limit and number of lines you buy help determine the boost you can get.

What is an Authorized User?

An authorized user is a person who is listed on a credit account that they do not own. Being an authorized user on a credit account can help a person boost their credit score or increase their available credit. With Credit Healing , people who want to establish or increase their credit for various purposes like signing a lease or purchasing a car can become an authorized user on another person’s credit account. Authorized users do not have the ability to access or spend on the credit account.

What is a Special Address?

It is the address associated with the credit line. Some lines require that you add that line to your credit report by updating that address in the personal settings of your credit monitoring service 4-10 days after the statement date.

Do I Get a Card? Where Is My Card?

No, the authorized user is never given access to a credit card nor can they spend on it. Cards are sent directly to the original cardholder’s primary billing address. Authorized users will not be able to call the credit card company to access the account as they will not have the necessary security information.

Is This Legal?

Adding an authorized user is backed by the Fair Credit Reporting Act (FCRA) and explained in most paperwork that comes with your credit card. The process itself is an option available to all credit card holders and has often been used for children, relatives, and friends. This said, we are not lawyers so we suggest consulting an attorney for further questions.

What is a Tradeline?

A credit report tradeline is simply an industry term to describe a credit account. If you have credit accounts, you therefore have tradelines. Tradelines come in the form of credit cards, lines of credit, car loans, mortgages, and payday advances. Here at Credit Healing , we focus solely on credit card tradelines.

When will I see the credit history for the tradelines I have ordered appear on my credit file?

The lines should report to your credit file within 7-14 days after the statement date.

Who Are The Credit Card Holders?

Credit card holders who use Credit Healing are everyday people with a good credit history who want to help people looking to increase their credit scores for a limited period of time. They do this by selling their tradelines.

What does the statement date mean?

The statement date is the date the credit card company reports to the credit history to the bureaus.

What happens if I don’t see the credit history for the line(s) I ordered on my credit report after 2 weeks?

You will need to report the line that did not post to our Customer Support department. We will review your credit report to verify that the line did not post. If you have followed all the instructions and the line is not there, you will receive a comparable tradeline or a refund.

Is My Information Protected?

Absolutely! We make sure to follow all local, state and federal laws to ensure the protection of our customers.